The sharp selloff in crypto tokens since late November has done little to dent appetite for stablecoins, their less exciting cousins.

While the likes of Binance Coin, Solana, Cardano and Polkadot have dropped 36% or more from their record levels, the market value of stablecoins — whose value are pegged to another asset, often the U.S. dollar — has continued to expand.

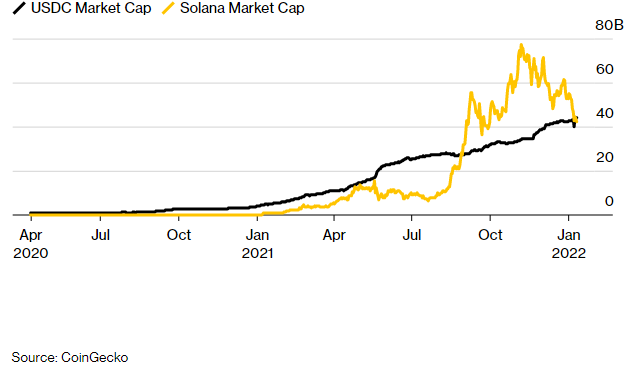

Tether (USDT) now has a market cap of $78.5 billion, according to CoinGecko data, putting it behind just Bitcoin and Ether. USD Coin (USDC) recently edged out Solana to take the fifth spot at $44 billion.

One reason for the healthy appetite for stablecoins in an otherwise choppy market is that they offer investors a way to generate juicy yields, said Hayden Hughes, chief executive officer of Alpha Impact, a social media platform for crypto traders.

“Market participants are eager to borrow stablecoins to use as leverage to speculate on other assets, and this has created a lucrative borrow and lending market where lenders can lend stablecoins and earn 10% to 19% for loans that are fully collateralized,” said Hughes. “In volatile market periods this is much more attractive than just buying Bitcoin for many participants.”

Steady Stablecoin

USDC’s market cap has increased gradually and overtaken Solana again.