The hottest spot in crypto right now is coins with prices that don’t move.

Stablecoins, cryptocurrencies which peg their value to assets such as the U.S. dollar, have ballooned in size over the past few months as Bitcoin and other coins whipsaw.

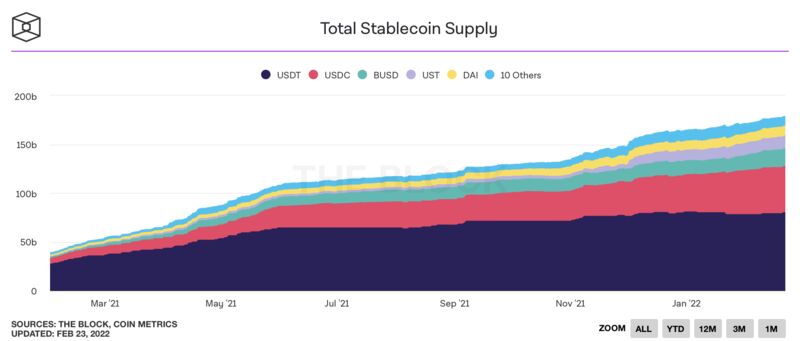

The total market capitalization of stablecoins currently stands around $180 billion, up from roughly $38 billion a year ago, Coin Metrics data compiled by The Block show. By comparison, the total crypto universe is largely stagnant over the past year.

The surge in market value shows that crypto traders are effectively moving their holdings to cash, according to James Malcolm of UBS. Bitcoin prices have collapsed by about 50% since mid-November, with many smaller coins posting even bigger declines.

Rather than moving money off crypto-trading exchanges by converting back into fiat currencies — a cumbersome and potentially costly process — it’s easier for investors to simply wait out the volatility in stablecoins, Malcolm said.

“There’s risk aversion, which creates flight to relative safety,” said Malcolm, head of foreign exchange and crypto research at UBS. “You park your money temporarily without taking it out of the ecosystem, and all the cost and hassle that involves.”

That’s especially evident Thursday amid the turmoil in Ukraine, with investors avoiding riskier and less liquid assets such as Bitcoin and turning to tradition refuges like gold.

Anxiety over how aggressively the Federal Reserve will tighten monetary policy has rattled risk assets, sending Bitcoin briefly below $33,000 last month. The coin has largely traded sideways since, with trading volume on exchanges shriveling.

That’s been a boon for stablecoins. While Tether is the largest at $80 billion, USD Coin is quickly gaining share — total market value stands at $47 billion, compared to under $6 billion one year ago.

“If USDC and USDT continue growing at similar rates as so far in 2022, USDC will become the largest stablecoin by market cap at the end of June,” Arcane Research wrote in a report.

Stablecoins maintain their fixed exchange-rate by holdings reserves, such as commercial paper or Treasuries. For that reason, the rapid growth of stablecoins has attracted scrutiny from U.S. regulators and the Treasury Department for potential financial stability risks.

However, the usefulness of stablecoins in transferring and storing funds with the crypto ecosystem has fueled nearly unabated growth.

“To me, what is happening is that the crypto ecosystem is growing into a kind of shadow banking system with its own leverage, its own fractional reserve kind of setup,” said Brent Donnelly, president of Spectra Markets.

“Over time, the crypto ecosystem just becomes a separate parallel system and as air comes out of crypto prices, the sellers leave their cash in stablecoins as there’s no real point moving it back and forth to and from fiat.”

— With assistance by Akayla Gardner, and Vildana Hajric. Read full story on Bloomberg