If you’ve been following crypto over the last several months, you have no doubt encountered the popular (3, 3) meme. People put it, or variations on it, in their Twitter handle, for example.

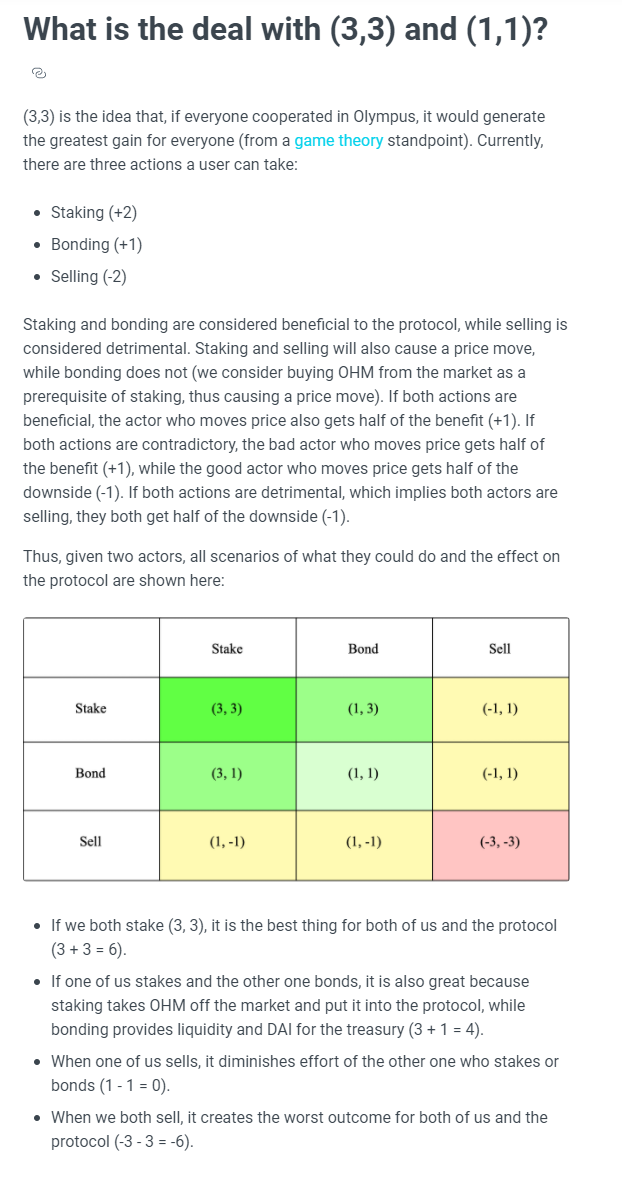

It’s taken on a life of its own, but it originated with a popular cryptocurrency called OlympusDAO, or OHM, and it refers to the corner of the project’s payoff matrix where everyone wins if everyone cooperates.

The project’s frequently asked questions page is here. The gist is basically that if everyone who owns OHM stakes their coins — in other words, locks them up in the project — then the price goes up. And if people sell, then the price goes down. About as simple as it gets, and yet it’s captured people’s imagination.

There’s a little bit more to it than just the part above. The coin has its own Treasury and holdings and it aims to be a non-pegged, decentralized stablecoin (whatever that means). But that’s a long way off and, for the moment, kind of beside the point.

During the boom, the coin had an amazing run. The (3, 3) meme is amazing, it has an army of fans called Ohmies and even a pseudonymous founder (Zeus).

The other key element is the outrageously high annual percentage yields being offered to OHM holders. Currently it’s paying out over a 4,000% APY (in OHM) to holders who stake.

Actually, the yield was way higher throughout most of the coin’s lifetime. The eye-popping APYs spawned numerous OHM clones and imitators on various chains. Even fans of the coin often ironically (?) refer to it as a Ponzi scheme.

Anyway, right now OHM is definitely experiencing the bottom right corner of the matrix (-3, -3) as it’s absolutely getting killed.

Per CoinGecko, it’s down over 30% in just the last 24 hours. Over the last 30 days, it’s been cut in half.

There’s not some obvious explanation for what’s going on.

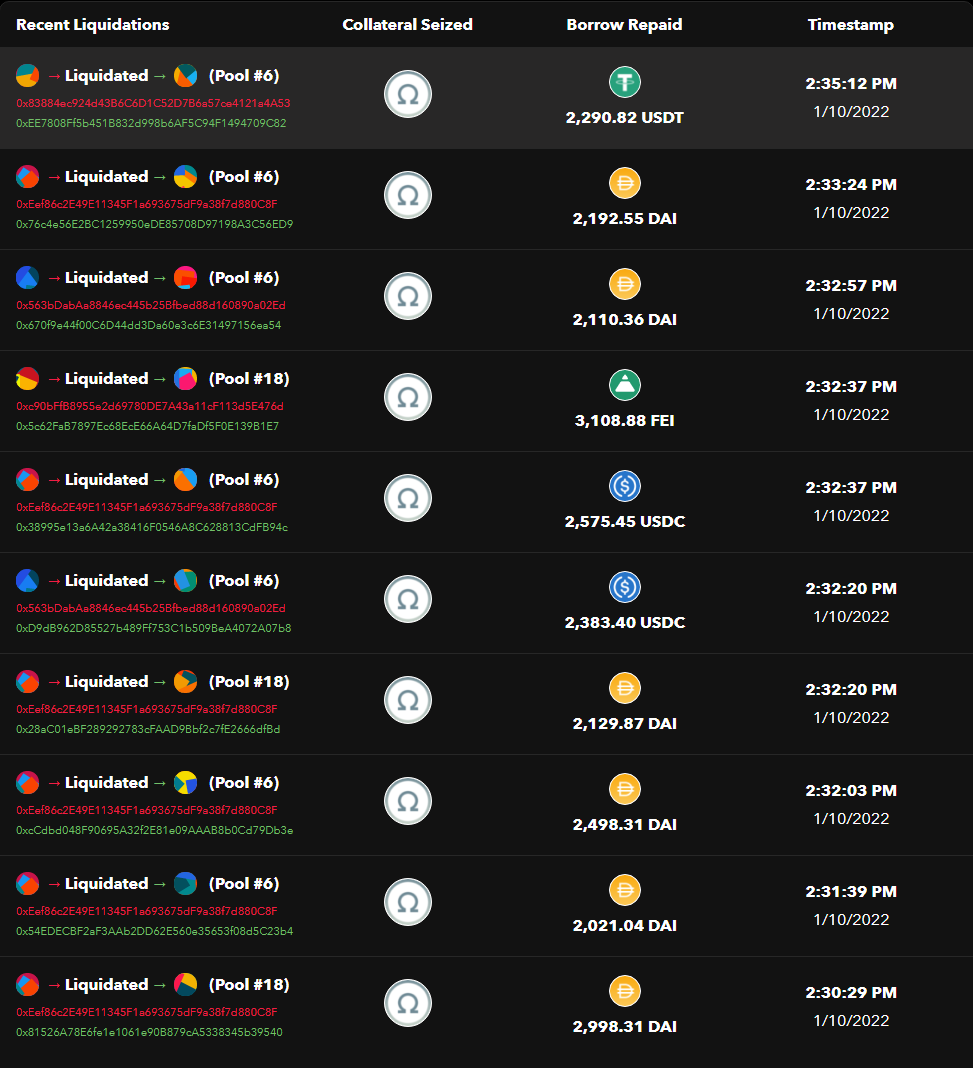

One thing to watch is that there is a stream of OHM liquidations happening on a platform where traders can post their coins, borrow currency, and then buy more OHM, which they can then restake. You can see here an endless stream of transactions, where people are having their OHM seized by the smart contract, as the price falls.

That, in itself, doesn’t explain much. But like many things in crypto, what underpinned the price is basically the meme and the community. And when that starts to unravel — like a lot of crypto price charts lately — well, there’s not some natural mechanism to boost it back up.

Read full story on Bloomberg