Crypto exchange Bullish is eyeing a public debut in the second quarter after regulatory delays kept the company backed by billionaires Peter Thiel and Richard Li from merging with a special purpose acquisition company and listings shares at the end of last year.

Bullish extended the March deadline for its $9 billion tie-up with Far Peak Acquisition Corp. to May on Tuesday as the agreement still awaits approval by the U.S. Securities and Exchange Commission.

The deal is among a slew of crypto firms merging with SPACs that have been slowed down by regulatory reviews, including stablecoin operator Circle and Israeli crypto platform operator eToro Group.

Setting up the exchange has been “hectic,” according to Tom Farley, chief of Far Peak and expected CEO of the combined company.

Launched in November, Bullish allows institutions and retail customers to trade Bitcoin, Ether, Eos and USDC, and is available in more than 40 jurisdictions in Asia Pacific, Europe, Africa and Latin America.

The company was started by blockchain company Block.one, which is backed by PayPal cofounder Thiel as well as hedge fund managers Alan Howard and Louis Bacon.

It has not yet decided whether it will move into the U.S., but has started the process of getting state approvals, according to Farley who previously served as president of the New York Stock Exchange.

“Since July we’ve been working on a number of ambitious promises and we’ve achieved them all with the exception of closing the SPAC transaction,” Farley said. “It’s been a hectic six months that includes launching an exchange and growing it more quickly over the three months than any other exchange we know of.”

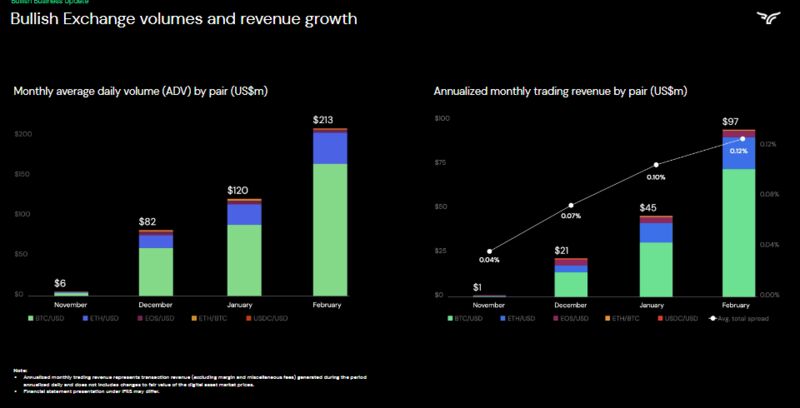

Monthly average daily volume by trading pair, a key industry metric, reached $213 million in February from $6 million in November, an investor presentation published Tuesday shows. Still that’s small in comparison to Binance, the world’s largest crypto exchange. Its trading volume over the past 24 hours was $81.8 billion.

Far Peak shares traded flat Wednesday amid a continuing rout in that corner of equity capital markets. Likewise, the SPAC tied to Circle, Concord Acquisition Corp., and the one linked to eToro, FinTech Acquisition Corp. V, were also little changed.

Read full story on Bloomberg