At the end of his latest note, Credit Suisse Group AG strategist Zoltan Pozsar ended on a tantalizing conclusion.

After this war is over, “money” will never be the same again… …and Bitcoin (if it still exists then) will probably benefit from all this

The increased role for Bitcoin follows naturally from his framework of inside vs. outside money, which he discussed extensively on a recent episode of the Odd Lots podcast. Inside money is someone else’s liability.

And as the Russian government recently learned with its foreign FX reserves — and the Canadian truckers recently learned with their money in the bank — access to that money can go away.

Outside money exists independent of that web. Gold is outside money. And of course Bitcoin is outside money as well.

If you never looked at a price chart, you’d think it would be a pretty great time for Bitcoin.

Inflation is sky high, and that’s supposed to be part of the digital currency’s appeal, to shield you at a time of rising prices.

The aforementioned Canadian truck drivers revealed what everyone should have already known that one can get deplatformed from the financial system, creating a need for money that’s not in a standard bank. And then the sanctions on Russia, in theory, you would think would create demand for money that’s digital — but which can’t easily be blocked, censored, or seized.

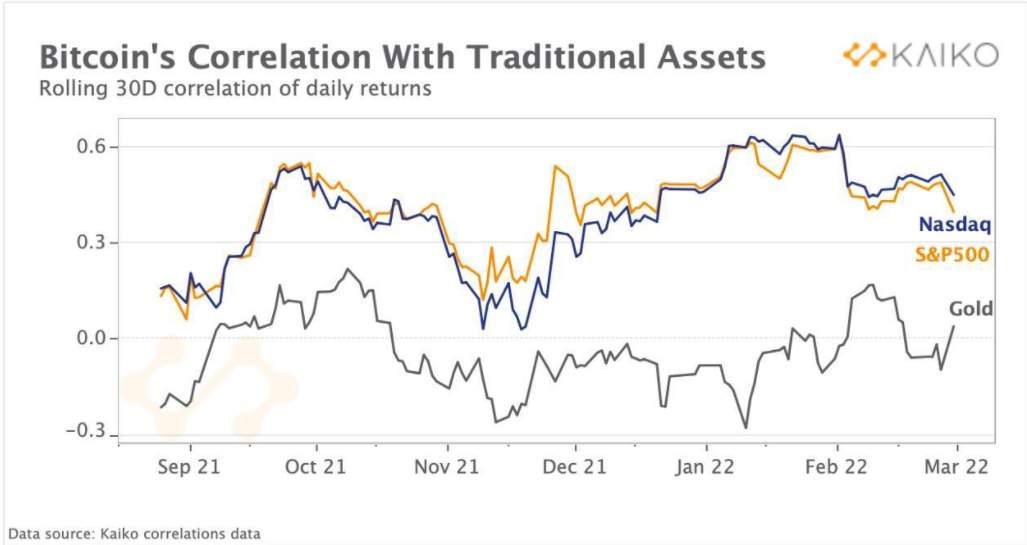

And yet really Bitcoin itself hasn’t done too much special. It still just looks like a tech stock. It’s not a perfect correlation by any stretch, but Bitcoin peaked within a few days of the QQQ ETF, and its recent bounces and bottoms have basically been at the same time.

The big problem seems to be that for all of the rhetoric about how it’s an inflation hedge and freedom money and all that, it’s just not really treated like that by the actual people who trade it.

As Roshun Patel, the VP of Lending at Genesis Trading put it, “Bitcoin has already become fairly institutionalized with a lot of the same people who trade tech stocks trading Bitcoin so when derisking happens they tend to view it in a similar risk bucket to tech equities and thus feeling the pain. BUT ever so slightly more recently the correlation to gold has ticked up and slide against Nasdaq.”

There does seem to be some modest correlation shift of late:

Of course, looming over all this is the threat of increased regulation. And here we may get to the heart of the tension.

So far, regulatory action has been pretty light touch. The industry is growing rapidly and getting much more accepted by mainstream financial institutions. However, what seems to be the case is that regulators are fine with Bitcoin (and crypto more broadly) as long as it’s basically seen as an investment asset.

People are allowed to speculate. People are allowed to hedge against inflation. But it gets trickier if Bitcoin were to be seen as a tool for moving money outside of centralized, regulated authorities.

“I would say bc the reprisals against unsanctioned BTC usage by Canadian and U.S. gov are pretty strong victories for the nocoiner perspective”, said Nic Carter, a co-founder and general partner at Castle Island Ventures, when asked why we haven’t seen more of a boom.

In other words, to whatever extent the Canadian trucker story would be seen as bullish for Bitcoin (because it got people thinking about ways of making payments without regulated entities) it’s also bearish for Bitcoin (because it caught the attention of state actors who wanted to push back against such payments.)

The Russian sanctions likely have the same general effect. Yes, some people will want to use crypto to get around sanctions or payment processors cutting them off. But on the flipside, the situation has only heightened the scrutiny of Bitcoin/crypto from a security perspective.

“The state really does seem to be dealing with it rather effectively for now… that gives the skeptics at the macro funds pretty good air cover,” said Carter.

And this actually gets to the comment from Pozsar at the very beginning. While he thinks this whole episode may be bullish for Bitcoin, he included the key parenthetical “(if it still exists then)”. In other words, the same forces that may propel Bitcoin upward are the same forces that may propel regulators to attempt to ban it or curtail the token in some way. So maybe it’s a wash.

In a follow-up email, Pozsar put it well, with proper all-caps usage: “we are re-learning the theme that a SOVEREIGN HAS TO BE INVOLVED WITH THE QUESTION OF MONEY and Bitcoin is basically short the sovereign (conceptually).”

You can try to short the sovereign, but the sovereign may not take it well if you do.

At the end of his latest note, Credit Suisse Group AG strategist Zoltan Pozsar ended on a tantalizing conclusion.

The increased role for Bitcoin follows naturally from his framework of inside vs. outside money, which he discussed extensively on a recent episode of the Odd Lots podcast. Inside money is someone else’s liability. And as the Russian government recently learned with its foreign FX reserves — and the Canadian truckers recently learned with their money in the bank — access to that money can go away. Outside money exists independent of that web. Gold is outside money. And of course Bitcoin is outside money as well.

Read full story on Bloomberg