Banking has always meant bankers, the intermediaries who are trusted to arrange financial transactions and are responsible for their safe execution. But what if nobody were in the middle, just some computer code? That’s the goal of what’s known as decentralized finance, or DeFi, a movement that’s grown out of a decade of experimentation with cryptocurrencies and the blockchain technology behind them.

A DeFi world in which counterparties interact directly via so-called smart contracts would be more efficient and fair, its proponents say. Critics say that DeFi is just the latest installment of the hype, speculation and money-losing possibilities that surround crypto.

Now a global anti-money-laundering watchdog has challenged DeFi’s central premise that transactions can take place without any entity being responsible for them.

1. How does DeFi work?

DeFi revolves around applications known as dapps (for decentralized apps) that perform financial functions on the digital ledger technology called blockchain that was invented for Bitcoin but has since caught on more broadly. Dapps let people lend or borrow cryptocurrencies from others, bet on the rise or fall of a range of digital assets or trade them, and earn interest in a savings-like account. The transactions are governed by rules embedded in the smart contracts. Many of them can also hook onto each other and work together, thereby creating complex financial services.

2. What’s a smart contract?

It’s an “if X, then Y” agreement. You could consider an automatic payment plan with a traditional bank to be a smart contract: It will withdraw money to send to your mortgage company on the first of every month until it’s told to stop. DeFi contracts can be far more complex. And instead of making an arrangement through an intermediary, DeFi apps are meant to directly connect counterparties. Smart contracts are automated, so once they’re launched they usually can’t be changed or halted.

3. What can DeFi users do?

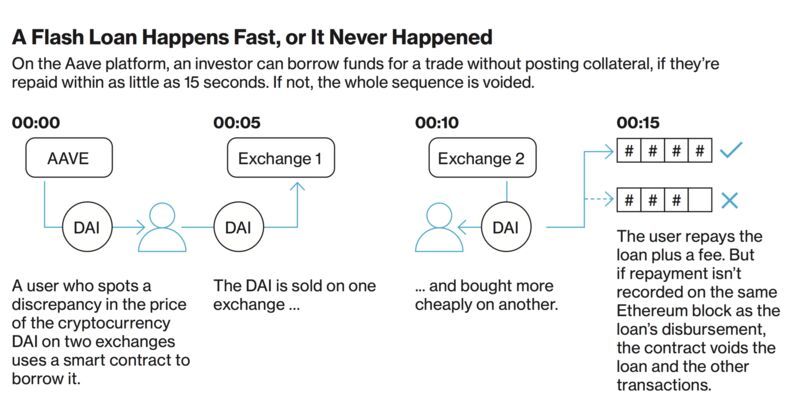

People with an account on a cryptocurrency exchange can connect it to a DeFi app and then lend some of their coins or borrow using their deposit as collateral. Or they can do more complex things like buy “wrapped Bitcoin,” a token used to allow Bitcoin transactions to take place on the Ethereum blockchain (the platform of choice for most dapps) and then enter into complex arrangements on DeFi apps to amp up their earnings. A more out-there option is something called flash loans, in which users write code to borrow coins and to return them with interest — after using them to buy and sell yet another coin — in transactions that are canceled if not completed at virtually the same time.

4. How big is DeFi?

Analysts chart the growth of dapps by looking at the collateral that many smart contracts require counterparties to post as a guarantee. That figure topped $100 billion in November, according to tracker DeFi Pulse — up from a few million dollars in 2017. Even with that surge, however, DeFi remained just a drop in the bucket of the $2.6 trillion overall cryptocurrency market.

5. Why all the interest in DeFi now?

In 2020, investments known as yield farming boomed on the promise of triple-digit returns using dapps such as Compound. More recently, there’s been a rise in dapps such as Aave that let users earn interest on their coins or borrow different cryptocurrencies for speculation.

6. What’s the potential benefit?

More than 1 billion people still don’t have access to basic banking services. DeFi’s supporters say it can change that by lowering transaction costs, while offering poor people the chance to earn a return on their savings, however small. They say DeFi will be the way money is democratized.

7. What are some pitfalls?

Hacking is one. A self-proclaimed white-hat hacker stole $610 million from PolyNetwork, a DeFi platform — before returning the funds. Speculators can also hype up a service and then bail, bringing an app’s value down. Some seem dominated by a few large investors, raising fears of manipulation. Users can wipe themselves out by accident dismayingly easily, by losing a password or sending coins to the wrong address.

8. What does the watchdog group say?

The Financial Action Task Force, which makes anti-money-laundering rules followed by governments worldwide, said in October that just because some function has become automated via a smart contract, that “does not relieve the controlling party of obligations.”

It said that entities it called Virtual Asset Service Providers will have to abide by money-laundering rules, be licensed or registered, and be supervised. In addition, the U.S. Securities and Exchange Commission is scrutinizing a number of DeFi platforms, laying the groundwork for what could become an expansion of regulation.

Read full story on Bloomberg